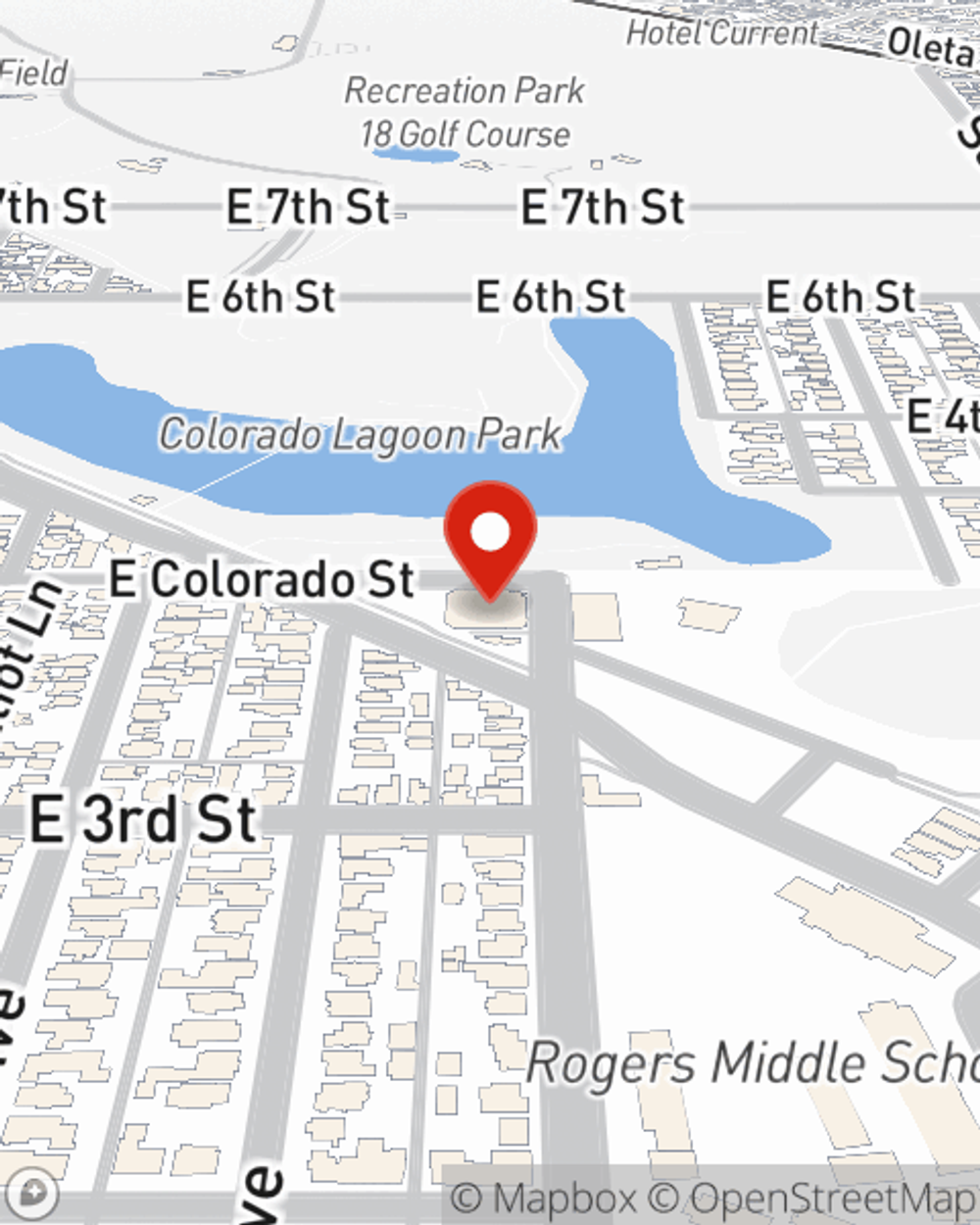

Business Insurance in and around Long Beach

One of Long Beach’s top choices for small business insurance.

No funny business here

Business Insurance At A Great Value!

Running a small business is no joke. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of trades, contractors, specialized professions and more!

One of Long Beach’s top choices for small business insurance.

No funny business here

Cover Your Business Assets

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for business owners policies, commercial auto or surety and fidelity bonds.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Keir Jones is here to help you discover your options. Reach out today!

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Keir Jones

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.